About AML Analytics

AML Analytics are world leaders in the testing and validation of sanction screening and transaction monitoring systems used by regulated financial institutions for protection against the risks associated with financial crime. We also test the AML/CFT systems of crypto exchanges and virtual currency businesses.

Find out more about Global Benchmark, Sandbox and Red Flag Tests.

Our innovative tests establish the effectiveness and the efficiency of sanction screening and transaction monitoring systems to help traditional and non-traditional financial institutions meet regulatory requirements, minimise exposure to financial crime risk and ensure robust detection systems are in place.

We currently work with several of the largest banks in the world and we have tested many thousands of AML/CFT systems since our incorporation in 2010.

AML Analytics also partners with regulators, supervisors and central banks around the globe delivering technical expertise and advanced SupTech to test and validate the AML/CFT systems of regulated entities as an integral part of a Thematic Review.

Detailed analytics enable regulatory authorities to gain important supervisory insight into the sanction screening and transaction monitoring strengths and weaknesses of their regulated entities, providing insight and understanding about prevalent and emerging financial crime risks in an entire market.

A newly-created division of AML Analytics

AMLC are a team of global specialists in AML/CFT consulting who work with financial institutions, crypto businesses, governments and regulatory authorities around the world.

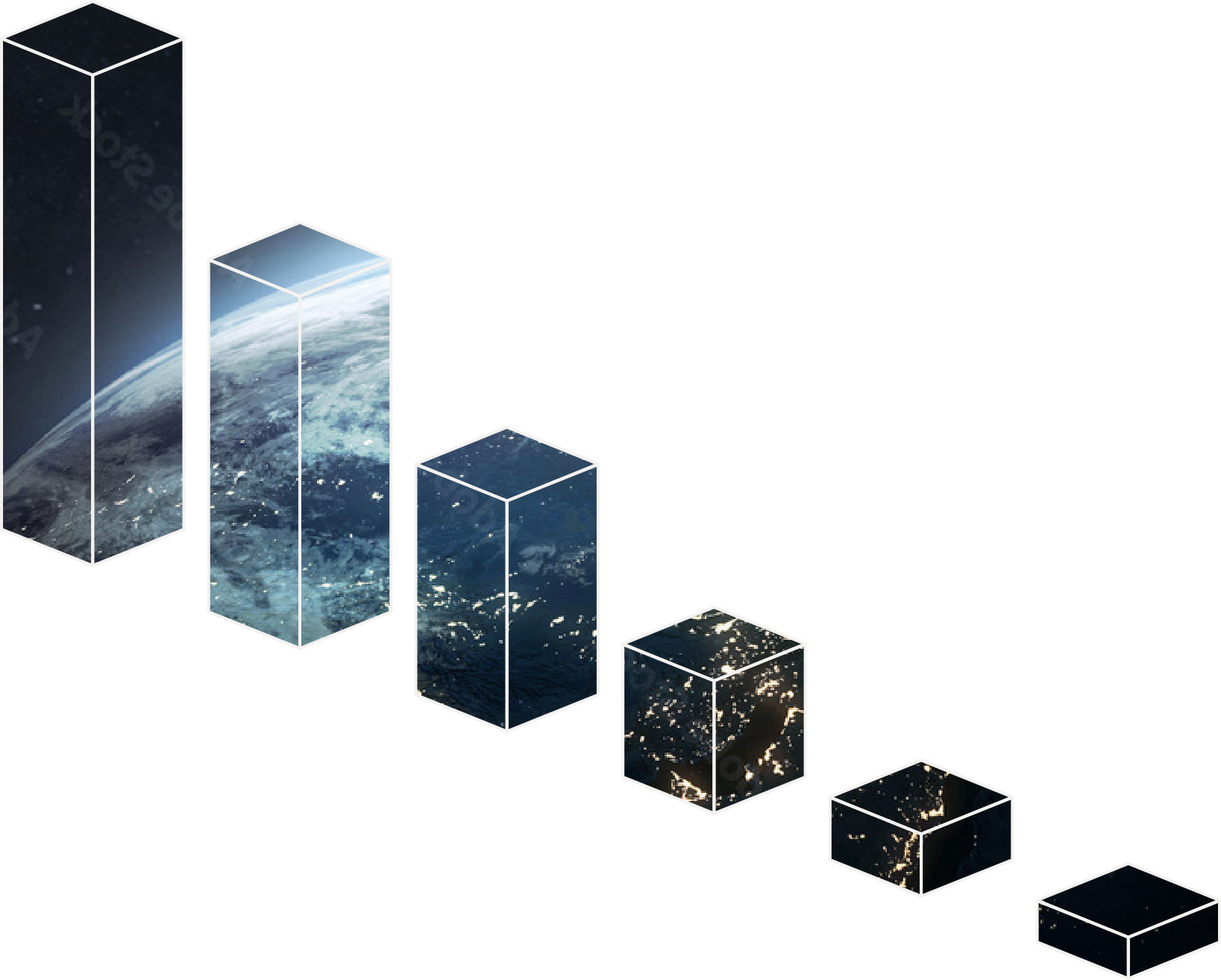

We are present in all the major financial markets on the planet providing strategic advice, practical guidance, technical expertise and cutting-edge technologies.

We help our clients navigate the ever-changing regulatory landscape, mitigate the risks of exposure to money laundering and terrorist financing and ensure effective risk-based frameworks are in place for sustainable supervision.

A different approach to supervision will bring significantly better outcomes and we believe that the future is data driven, digital and facilitated by technology. This technology is ORBS (Online Risk Based Systems) and ORBS will deliver our vision of sustainable supervision for corporates and regulatory authorities.

Latest Insights

Get the latest news and announcements from AML Analytics

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.