Sandbox is a powerful

self-assessment tool designed so that customers can build their own sanction screening tests to suit their

specific requirements and

corporate risk appetite.

The benefits of Sandbox

Choose from a wide range of sanction list and PEP data

Up-to-the-minute sanction list data will always be available for each test

Minimise AML/CFT risk by understanding your sanction screening system

Reports are automatically generated for internal and external reporting

Identify AML programmes in need of tuning for compliance

Aids pre/post-deployment testing of a new sanction screening system

Meet stringent regulatory requirements on an ongoing basis

AML Analytics has no affinity to any supplier of automated systems

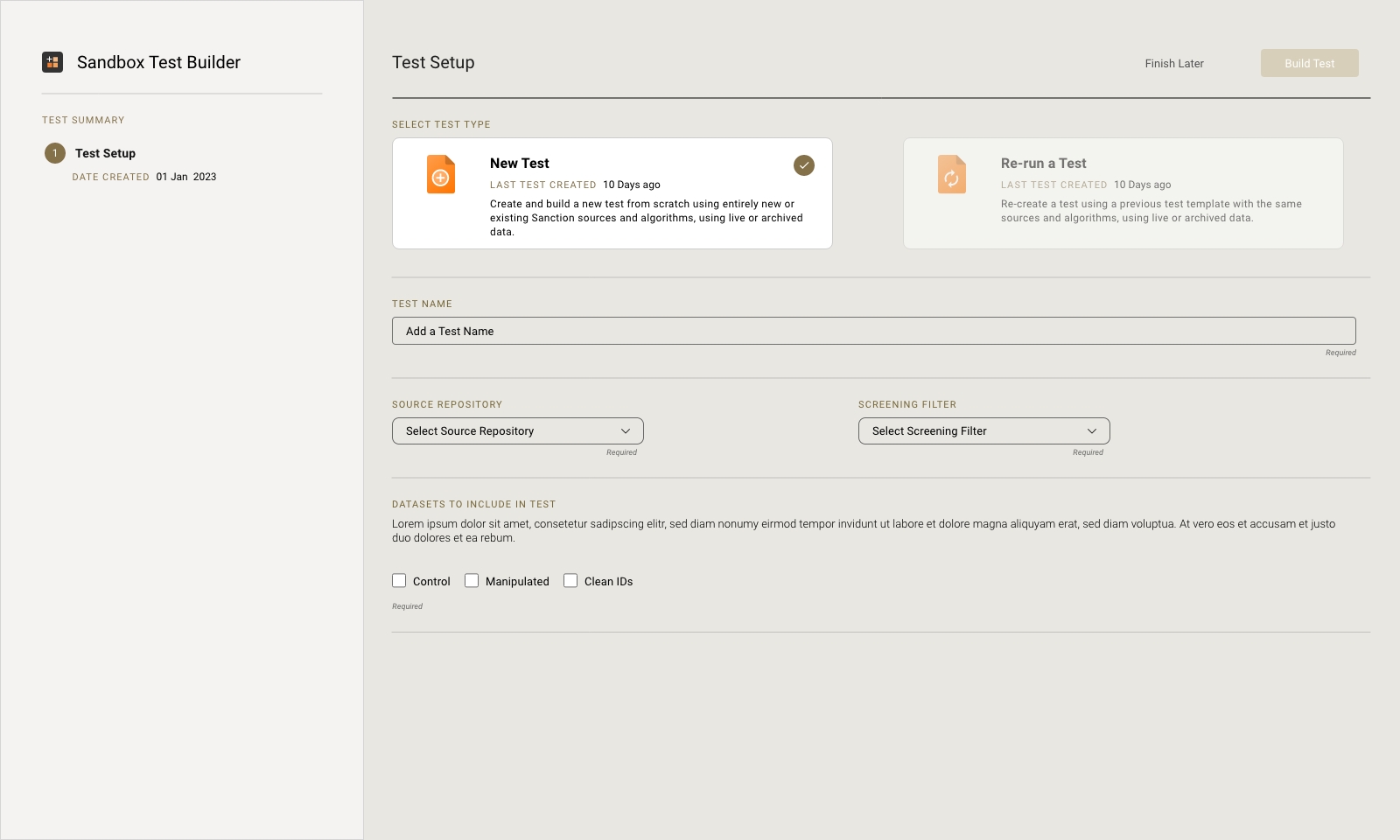

Build your own tests with Sandbox

General tests covering a wide selection of sanction sources and PEP data can quickly and easily be built in Sandbox, as well as test datasets to target specific weaknesses in a sanction screening system’s matching capability. Build your own test according to your specific corporate requirements and select from numerous options including sanction lists, record type, number of records, algorithms and non-sanction records.

Choose from a large selection of algorithms to manipulate sanction records in your test and assess the fuzzy logic matching capabilities of a screening system. Algorithmic manipulation will stress test a screening system and make it harder for a system to identify and alert against sanction records.

Ongoing, rigorous Sandbox testing facilitates understanding of a sanction screening system’s strengths and weaknesses so that changes can be made to ensure it is fit for purpose, enabling confident reporting to regulatory authorities.

Navigate seamlessly between AML Analytics solutions with the brand-new AMLA® Hub.

Effectiveness and efficiency

Sandbox also enables specialised testing of sanction screening systems using Chinese Character names. AML Analytics has created unique algorithms for the manipulation of Chinese Characters to help our customers in Asia to comprehensively test the effectiveness and the efficiency of their sanction screening system technologies.

It supports regulatory expectations in terms of pre- and post-deployment testing of a new screening system as well as the iterative tuning process that is necessary to support a new deployment.

Our Sandbox tool is also used by regulators as an integral part of a Thematic Review to test the performance of the sanction screening systems used by their regulated entities.

AML Analytics is an independent provider of sanction screening system testing technologies with no affinity to any supplier of automated systems.

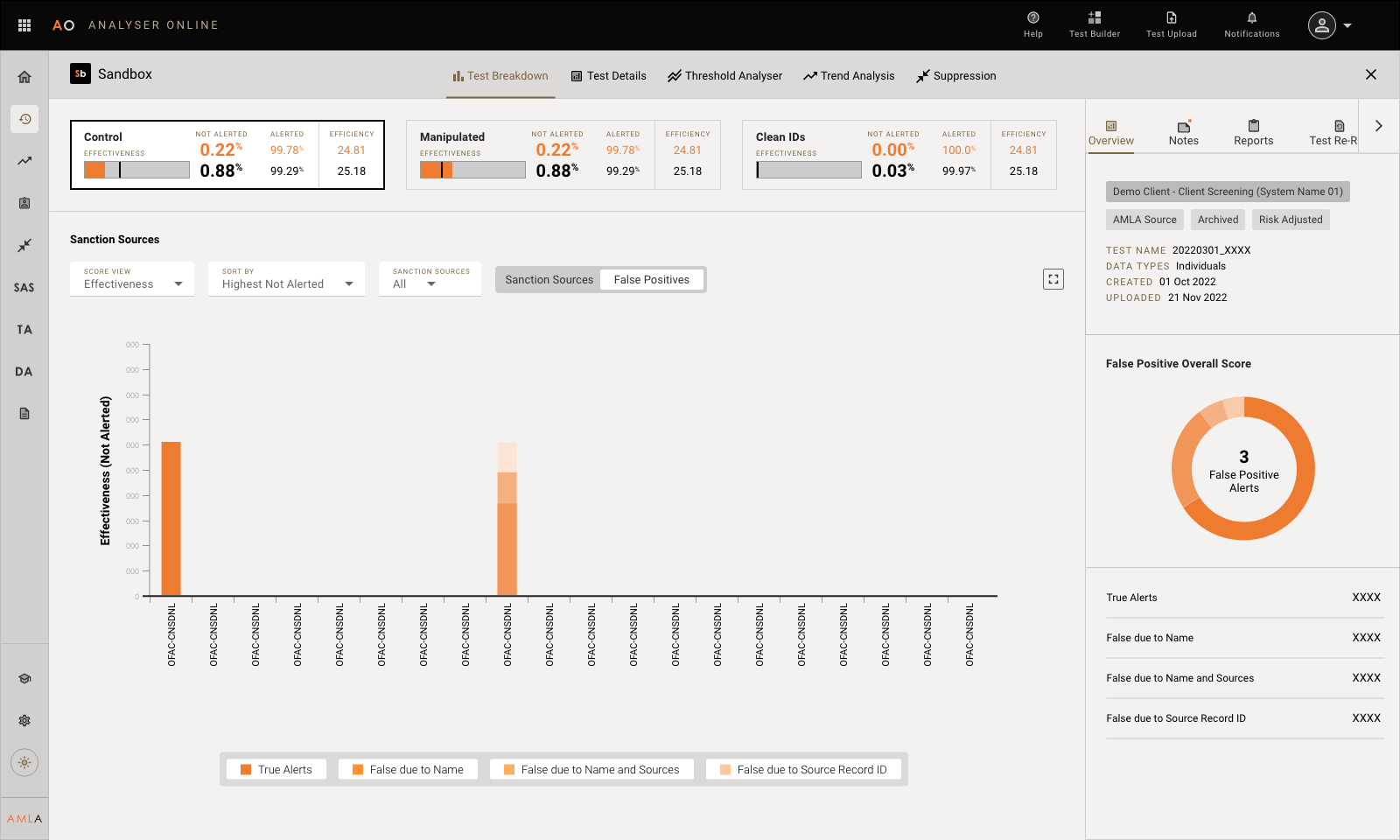

False Positives

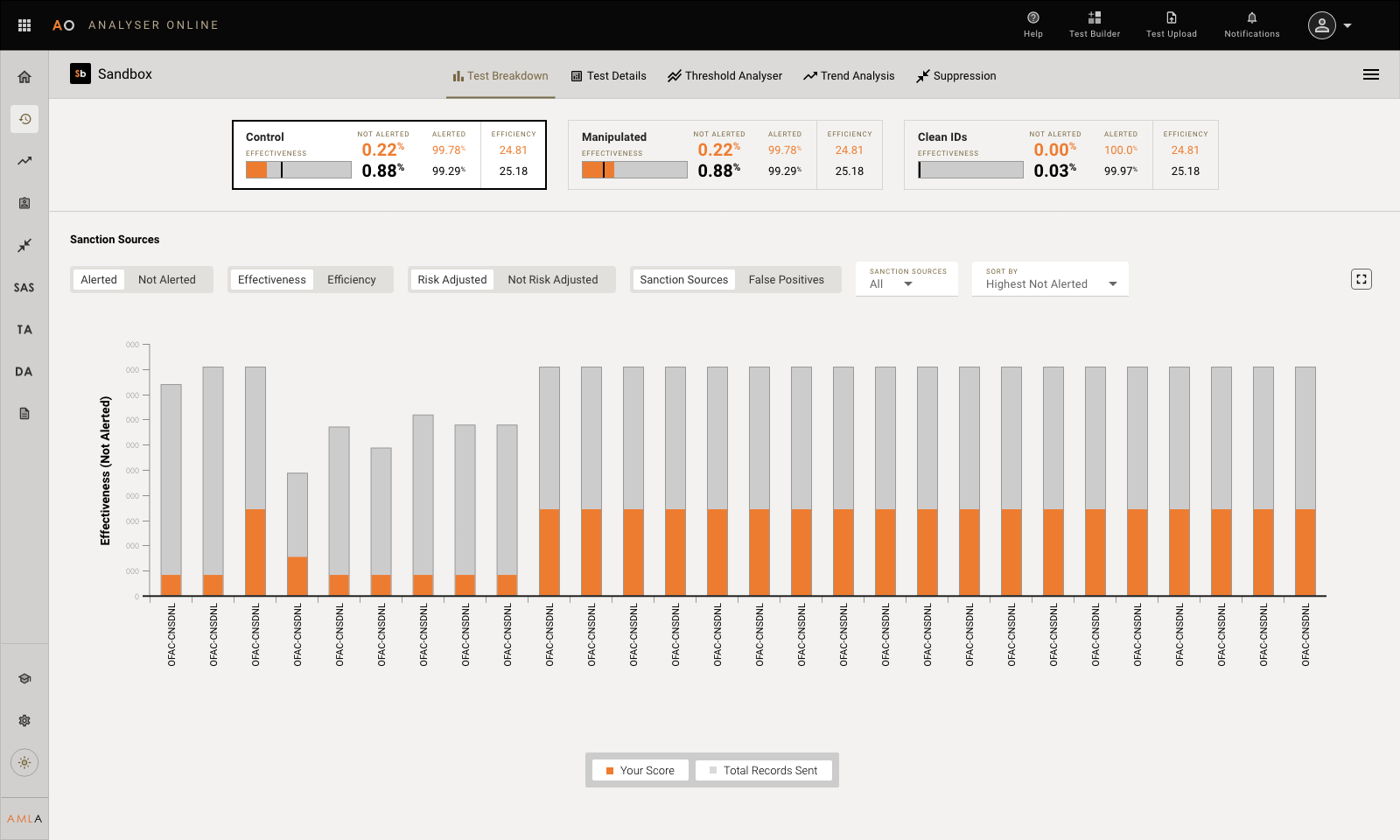

Test results are available for analysis and review in Analyser Online where side-by-side comparison graphics will help identify any problems concerning the efficiency and effectiveness of a screening system. Study False Positive alerts in granular detail to understand if iterative tuning is required.

AML Analytics monitors all significant sanction lists around the world for changes and our sanction list data is continually updated in real time for up-to-the minute Sandbox testing. Sign up to our Sanctions Alert Service to receive free notifications and updates whenever a change is made to a globally important sanction list.

Sandbox does not require any IT integration with a system or any access to customer data so there are no data protection issues. Total data security is ensured.

Control and manipulated tests

Control tests

Control tests are created by using records exactly as they appear on sanction lists and without making any changes to these names. These datasets are designed to test the pure matching capability of a system. A control test may include unchanged primary names and aliases of individuals, entities, vessels, aircraft, countries, territories and BICs (Business Identifier Codes) on sanction lists.

Manipulated tests

Manipulated tests include records that have been changed using algorithms from the way they appear on sanction lists in order to copy how a criminal might change their name or to emulate mistakes at data entry level. Using manipulated data in tests will test the fuzzy logic matching capabilities of a sanction screening system. It is normally harder for a sanction screening system to hit against records in a manipulated test than in a control test.

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.

Ready to talk?

Don’t hesitate to reach out to us.

info@aml-analytics.com

+44 (0) 1264 889 339