Sanction screening system tests with AMLA®’s Sandbox

Switch to the new Analyser Online here

One of the most widely recognised problems for compliance professionals is not only understanding how well a sanction screening system is performing, but how to go about creating sanction screening system tests to do this.

A sanction screening system must be tested frequently, and the results from each test must be understood in order to know what improvements and remediation steps need to be taken.

Across our work with global banks, we’ve learned that financial institutions often find it difficult to alert against algorithmically manipulated names during the sanction screening process, along with having a heavy reliance on manual processes with limited automation across the screening process.

We also discovered that some financial institutions don’t have any testing or auditing programmes in place. So let us tell you a bit about Sandbox, and how it can help solve common issues with regards to sanction screening system testing.

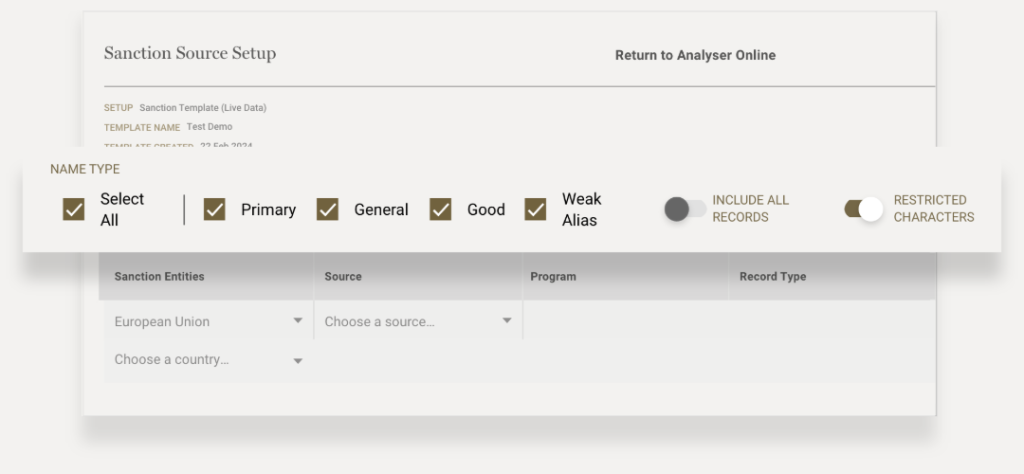

Sandbox from AML Analytics is a unique sanction screening system testing tool that has been designed so that customers can build their own sanction screening system tests tailored to the specific risk appetite of a business.

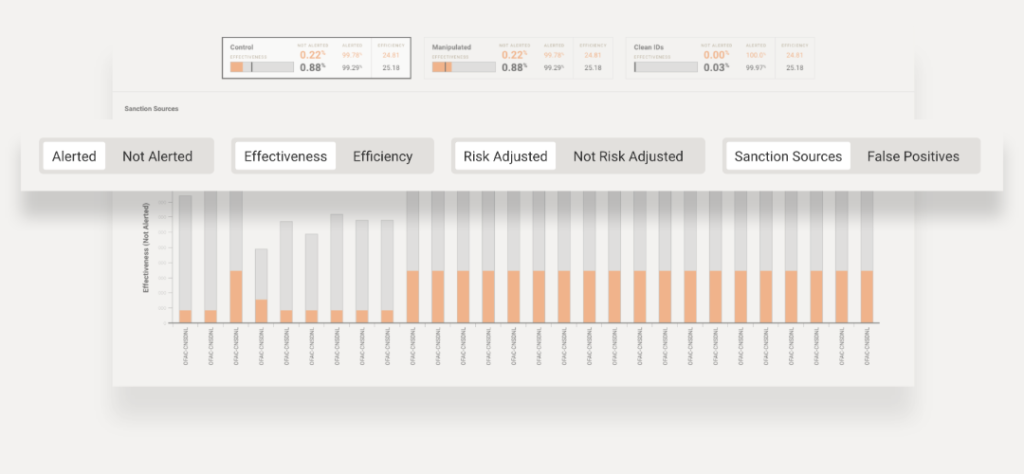

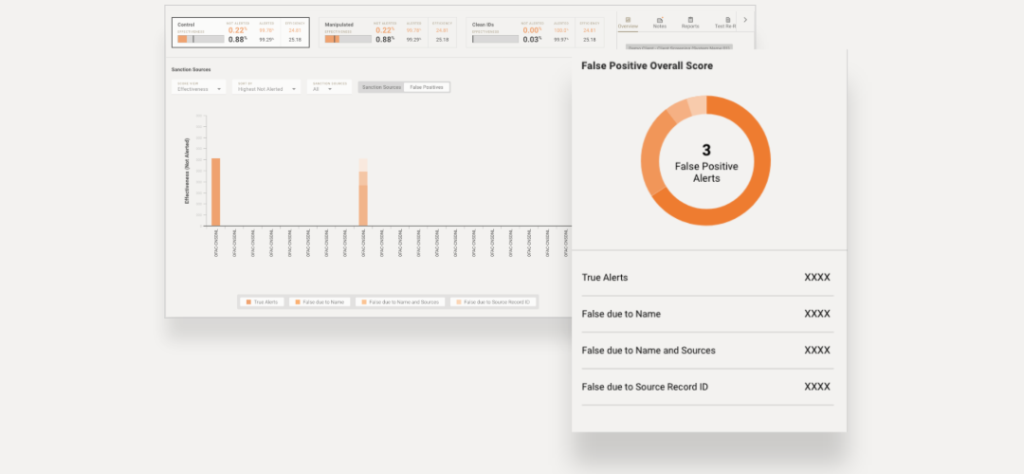

Sandbox offers a robust platform for constructing custom-built sanction screening tests to ensure that a system is performing as expected.

Tests can be built to target a system’s known weaknesses for full understanding and to ensure system improvement and enhancement. A range of sanction sources and PEP (politically exposed person) data can be included, enabling thorough evaluation of a screening system.

With Sandbox, you can:

By making use of the wide array of algorithms available in Sandbox to manipulate sanctioned records in a test, customers can:

Sandbox offers a wide range of testing options and can be used to:

Support pre-deployment and post-deployment testing of a new sanction screening system

Support the iterative tuning process when carrying out a system upgrade

Meet stringent regulatory requirements for ongoing and independent system testing for optimal performance

Identify non-effective sanction screening systems or AML programmes needing tuning for compliance

Minimise AML/CFT risk by understanding a sanction screening system and how it should operate

Create automatically generated system reports for each test that is run for internal reporting and external reporting to regulators

Rigorously test a system using a wide range of data (individuals, entities, aircraft, vessels, BICs and non-sanction records) to test a screening system to its limits

In the form of our Customer Experience Team, we offer one-on-one support and full training, getting you up to speed with how Sandbox works so you can utilise the benefits as soon as possible. Our dedicated, expert team are always on hand to respond to any questions.

To effectively execute sanction screening system testing, the correct data has to be involved. We ensure all our sanction list and PEP data is as up to date as it can be so that tests are built using the most recent records. This creates an extremely accurate testing environment.

Our free solution, Sanctions Alert Service (SAS), enables anyone who wishes to subscribe to see changes to the most important global sanction lists as they happen in real time.

It doesn’t matter where you are in the world, our global sales team is on hand to reach every corner. Our AML/CFT SupTech and RegTech technology is world leading and our expertise is absolute – it’s why we’re trusted globally by governments, regulators and central banks.

For any further information please contact us on info@aml-analytics.com and a member of our sales team will be in contact with you.

Starling Bank has been fined just shy of £29m for financial crime failings related to its sanctions screening systems. Starling saw rapid […]

The experts at AML Analytics are going to take you through the vital steps a financial institution should take to ensure a […]

Here at AML Analytics, a Thematic Review refers to the testing, review and comparison process of the anti-financial crime systems used by regulated entities. […]