Sanction screening system benchmarking created by the industry for the industry.

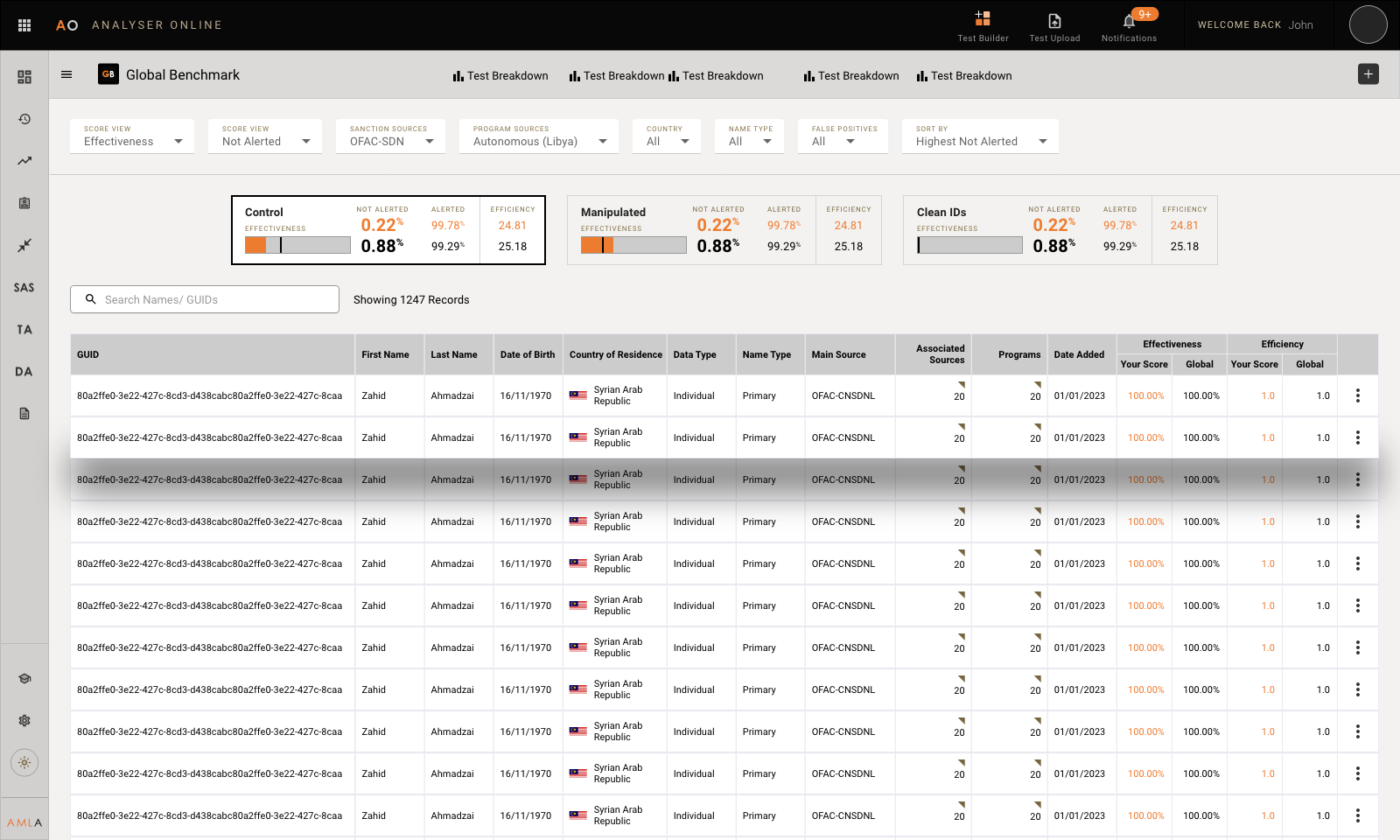

With Global Benchmark, measure your sanction screening system performance and then benchmark your scores each month against industry-standard aggregated scores of your peers around the world.

Global Benchmark benefits

Subscribe to Global Benchmark™ to measure your sanction screening system performance each month and then compare your efficiency and effectiveness scores to the industry-standard aggregated scores of your peers around the world. From here, regularly analyse and compare the efficiency and effectiveness of your sanction screening system in detail, driving ongoing system enhancement and improvement.

AML Analytics publishes monthly global, regional and industry-specific benchmark scores for both client and payment screening systems at control and manipulated level. We also provide specific benchmark scores for Chinese character testing and are the only company in the world to offer this.

The peer comparison process is easy using the advanced analysis features and interactive graphics available in our customer communication hub, Analyser Online™.

AML Analytics is an independent provider of sanction screening system testing technologies with no affinity to any supplier of automated systems.

Monthly Global Benchmark testing enables ongoing independent validation of a sanction screening system to ensure it is fit for purpose, facilitating frequent reporting to regulatory authorities.

Benchmark your sanction screening performance

Control – Customer Screening

Control – Transaction Screening

Manipulated – Customer Screening

Manipulated – Transaction Screening

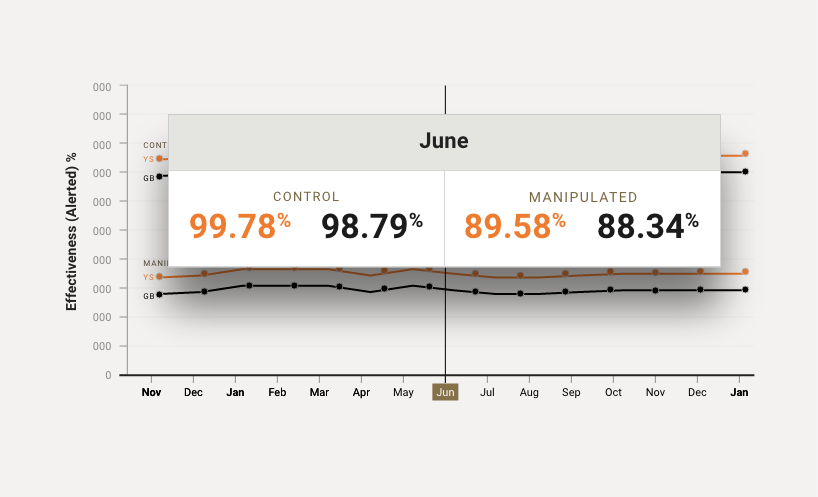

The Global Benchmark™ scores above are the very latest monthly scores that have been compiled using test results from all our Global Benchmark™ customers around the world.

These scores represent the average performance levels of sanction screening systems at both control and manipulated level for client screening and payment screening systems.

Global Benchmark™ is the easiest way to compare the performance of your sanction screening systems with your peers around the globe.

Access the latest data

AML Analytics creates a monthly Global Benchmark™ standardised test file using up-to-the-minute data from the most important global sanction lists. Our testing process is cost-effective and straightforward and we make sure that we have reflected important industry criteria in our tests.

Optimality first with Global Benchmark

To ensure the highest of standards, we now include non-sanction records in our Global Benchmark™ tests. Using records that should be missed by sanction screening systems guarantees they are functioning optimally.

Security matters

If the entire 22,000-strong OFAC-SDN list was tested and a score of 99% was produced, it would still mean that 220 names in their original form may not have been identified and captured by a screening system.

Benchmark scores

Insurance Benchmark

Created specifically from the monthly sanction screening system test results of insurance firms around the globe, Insurance Benchmark testing is a simple way for an insurance firm to measure the efficiency and effectiveness of its sanction screening system each month and then compare its scores to the aggregated scores of insurers around the world.

AML Analytics is the only company in the world to offer a sanction screening system performance benchmarking solution to the insurance market and the Insurance Benchmark is our first industry specific benchmark. Monthly Insurance Benchmark customer screening system scores are published at both control and manipulated level for customer screening systems.

Asia Benchmark

AML Analytics also offers an additional benchmark score to customers in Asia called the Asia Benchmark. Asia Benchmark scores are available at both control and manipulated level for customer screening systems and transaction screening systems.

Financial institutions subscribing to our Asia Benchmark service are able to measure their own sanction screening performance and then compare it specifically to their peers in Asia using the Asia Benchmark average scores in Analyser Online™.

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.

Ready to talk?

Don’t hesitate to reach out to us.

info@aml-analytics.com

+44 (0) 1264 889 339