A Thematic Review assesses the sanction screening and transaction monitoring systems used by regulated entities and is essential for regulators to gain oversight of their AML/CFT market risk.

Trusted industry experts

Thematic Reviews are essential for effective supervision, providing regulatory authorities with the knowledge, oversight and tools to understand and mitigate AML/CFT risks.

AML Analytics’ Thematic Review empowers regulators to optimise their resources and capacity. Our trusted solutions enable regulators to monitor markets and gain transparent overviews of systems used by regulated entities, backed by independent system testing to international best-practice standards.

With our technical expertise and state-of-the-art SupTech solutions, the Thematic Review process becomes simple and straightforward for regulators, supervisors, and central banks.

Thematic Review results now feed into ORBS (Online Risk Based Systems), our risk analytics solution, for high-level oversight and absolute clarity of an entire market’s AML/CFT risk.

To date, we’ve collaborated with over 50 regulatory authorities globally, testing the systems of over 900 regulated entities.

Sanction screening

system testing

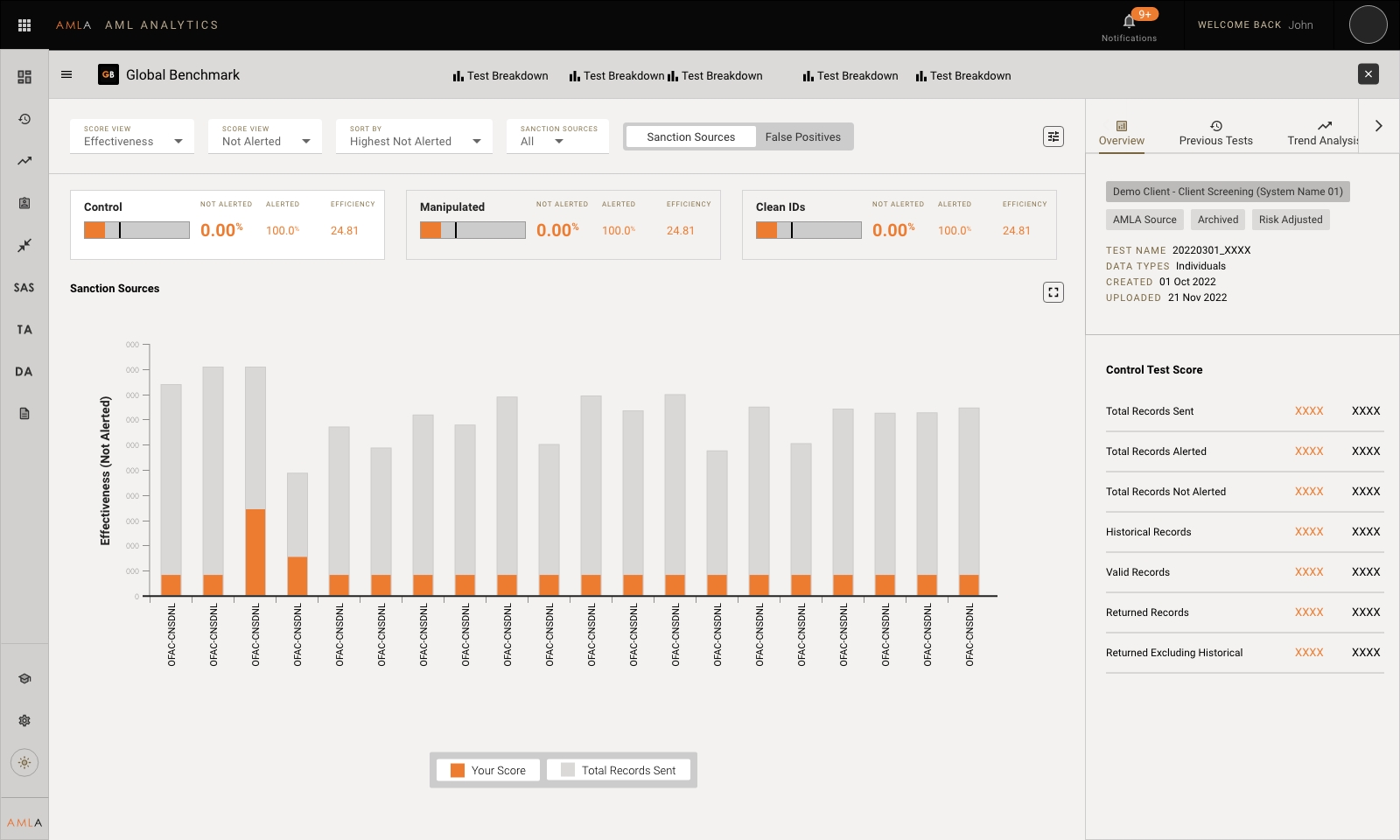

Our Sandbox solution provides the capability to deliver all the core components of a sanctions Thematic Review for ongoing regulatory supervision and reporting.

It’s an intuitive testing solution which allows for the creation of sanction testing heuristics which are configurable to suit a regulatory authority’s specific risk appetite.

It can also be used to build general tests which cover a wide selection of sanction and PEP information, as well as specific test datasets to target known weaknesses. This allows for iterative tuning and testing capability to provide ongoing system performance and enhancement across an entire market.

Access to Sandbox is via Analyser Online, where analysis tools provide granular level detail about every sanction record that has been hit or missed by a screening system.

Transaction monitoring

system testing

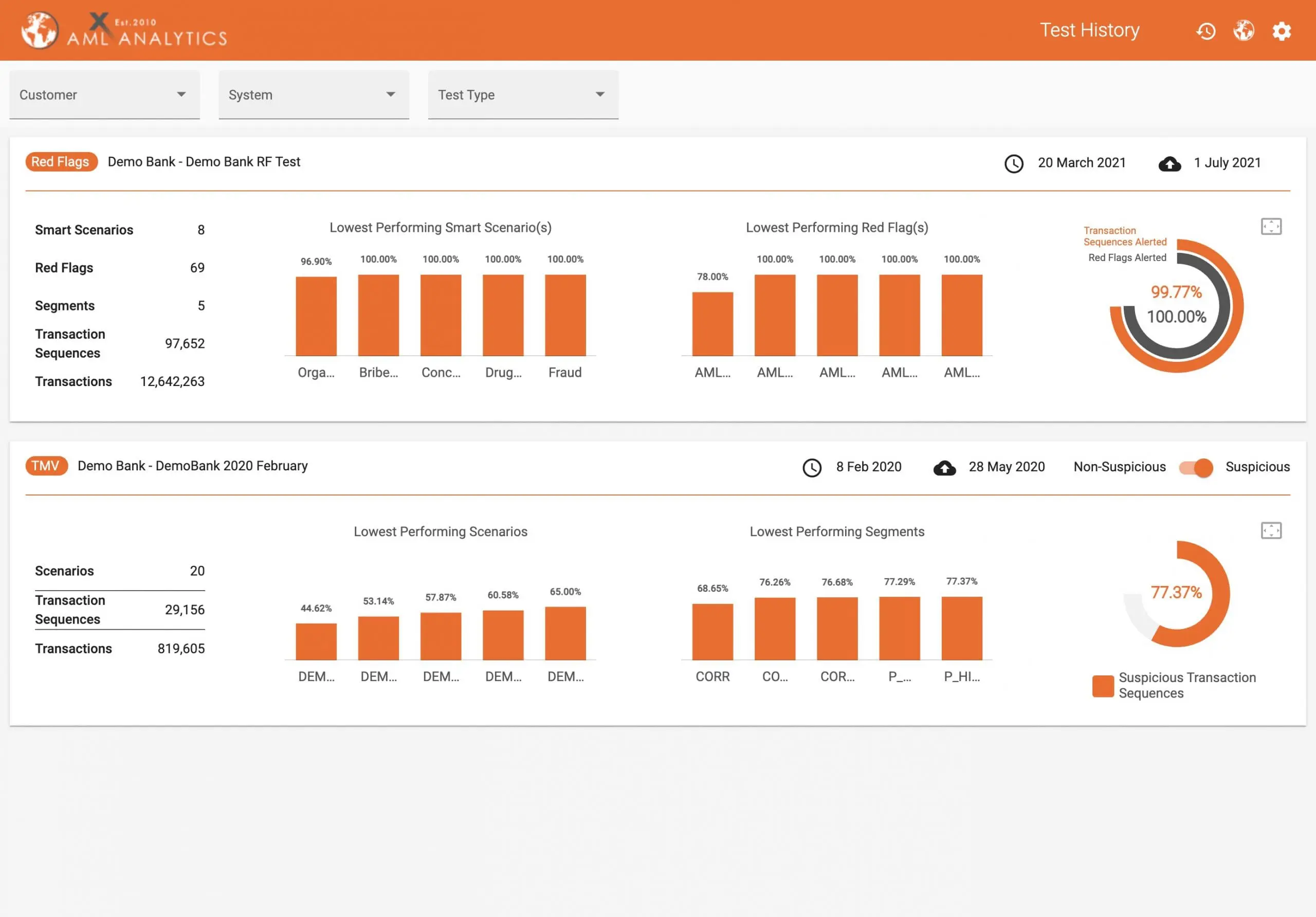

For transaction monitoring Thematic Reviews we use our Red Flag Tests solution. The process starts with an onboarding period to determine the formats in which red flag transaction sequences can be uploaded as a batch of transactions into the testing environment of each regulated entity’s transaction monitoring system.

Following the completion of the onboarding process, the full test will be provided to regulated entities to be run through their transaction monitoring systems. Each regulated entity will be tested simultaneously but over a longer time frame using a bespoke format that will be entirely compatible with their system.

Each test will contain synthetic transaction sequences to mimic the exact transactional patterns of defined money laundering typologies with the intention to trigger one or more of the regulated entity’s internal rules.

Red flags rules in a system will be challenged not just once, but multiple times and with variation in the transaction sequences. These are created in such a way that each sequence will be isolated from every other sequence so that a true understanding of a transaction monitoring system’s performance can be attained.

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.

Ready to talk?

Don’t hesitate to reach out to us.

info@aml-analytics.com

+44 (0) 1264 889 339