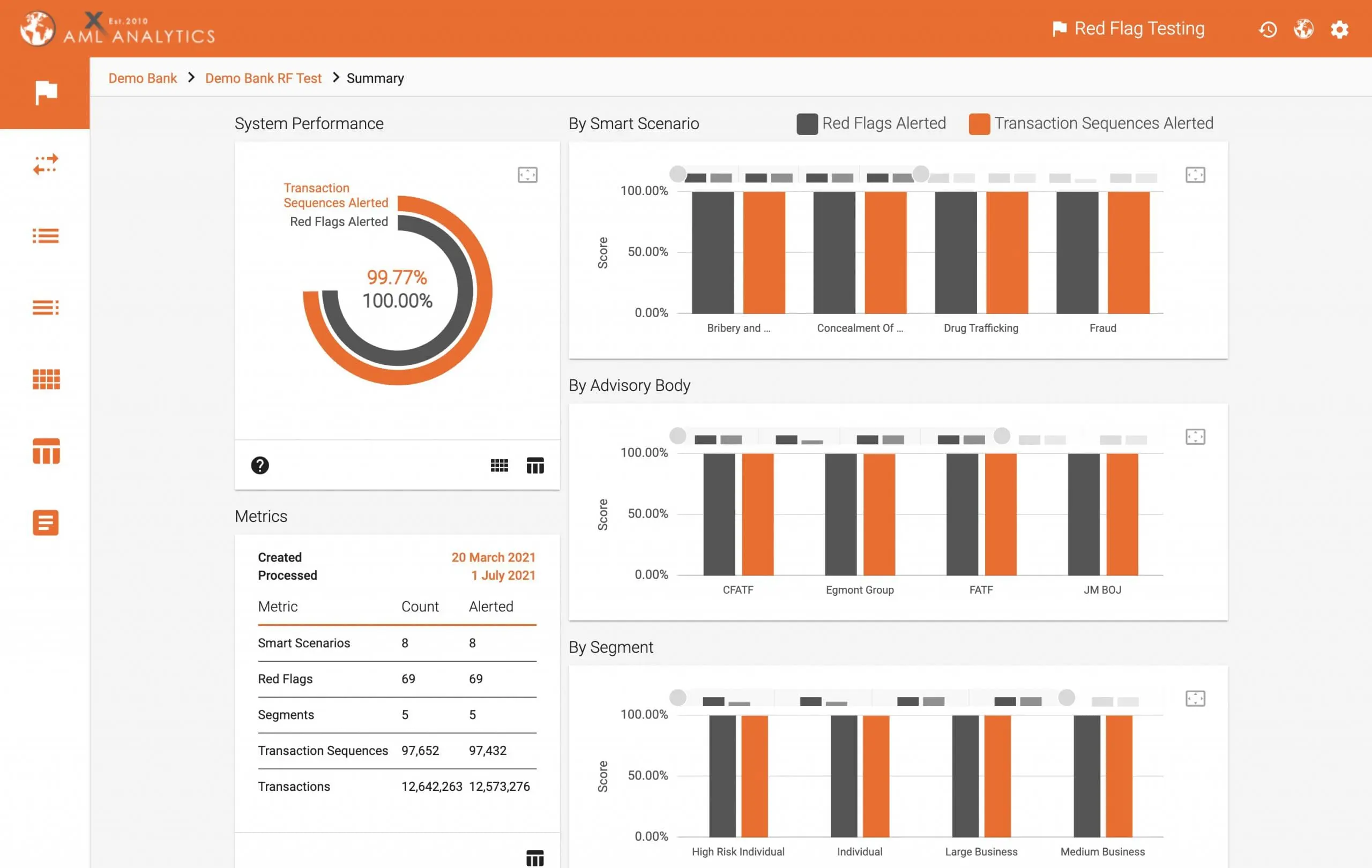

Red Flag Tests will perform a transaction monitoring system health check using Smart Scenarios made up of synthetic transaction data to validate performance.

A transaction monitoring health check

Red Flag Tests is a ground-breaking solution designed to carry out a transaction monitoring system health check using Smart Scenarios consisting of synthesised transaction data to validate system performance at the click of a button.

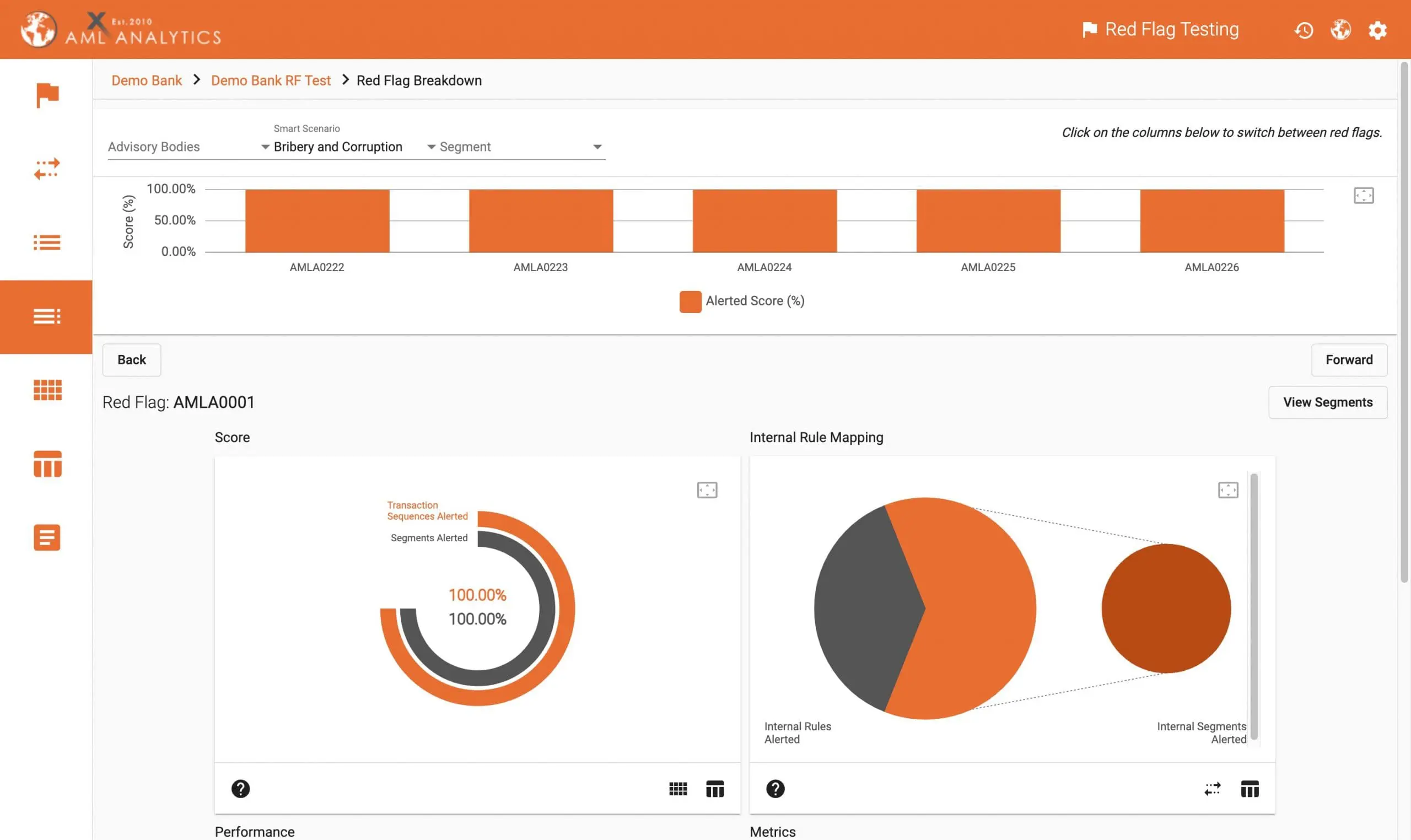

A red flag is a regulatory-referenced indicator that highlights potential illegal activity in a bank account. Red Flags are created from the knowledge and understanding of patterns that emerge from the analysis of criminal transactional activity. They are then defined according to regulation and guidance notes and assigned to a specific financial crime typology, such as the illegal wildlife trade or human trafficking.

Our innovative RegTech tests will exercise red flag rules using Smart Scenarios consisting of synthesised transaction data to pinpoint vulnerabilities in a system’s alerting capabilities and validate red flags at the click of a button.

The benefits of Red Flag Tests

Highlights transaction monitoring system inaccuracies

The red flags used are regulatory-referenced indicators

Prevent a system from producing unnecessary alerts

Reduce specific behavioural-type transactions being missed

Allocate limited resources more effectively where they are required

No other company can deliver such simple testing and validation

Smart Scenarios

Each Smart Scenario encompasses multiple red flags and covers different transactional behaviour to emulate the typical characteristics of a particular type of financial crime, such as modern slavery, proliferation financing, tax evasion or terrorism financing. Our Red Flag Tests contain synthetic data to mimic the exact transactional patterns of defined money laundering typologies such as the ones mentioned here.

Testing will highlight transaction monitoring system inaccuracies and identify incorrect threshold parameters that can cause a system to produce unnecessary alerts or miss specific behavioural-type transactions.

It will provide the intelligence required by a system technician to understand existing red flag assumptions and to then carry out remediation and post-testing enhancement activities to rid a transaction monitoring system of time-wasting inaccuracies. This will enable analysts to identify transactional patterns and behaviours consistent with known money laundering typologies more easily.

A unique database

We have collated a unique database of over 10,000 red flags that have been defined by regulators, law enforcement agencies and banking associations around the globe.

AML Analytics is leading international regulatory guidance on Red Flag Tests through specialist research. Our Red Flag Tests and Smart Scenarios have been created in accordance with international best practice recommendations and guidance from the FATF, UNODC, OCC, FinCEN, HKMA, and many others.

Our Red Flag Tests solution is also used by regulators as an integral part of a Thematic Review to test the performance of the transaction monitoring systems used by their regulated entities.

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.

Ready to talk?

Don’t hesitate to reach out to us.

info@aml-analytics.com

+44 (0) 1264 889 339