A versatile sanction screening system testing solution providing flexible long-term assurance that a system is fit for purpose.

The benefits of Annual Assurance Testing

Annual Assurance Testing (AAT) is needed by both traditional and non-traditional financial institutions to:

- Understand if your sanction screening system is performing with optimum effectiveness and efficiency in line with regulatory expectation

- Help you respond to increasing scrutiny from regulators as to the integrity of a sanction screening system

- Minimise an entity’s exposure to AML/CFT risk

- Provide an evidence-based reporting system that is trusted by multiple regulators around the globe

AAT is in line with minimum regulatory expectations for the testing of a sanction screening system on an annual basis.

Our testing methodology ensures total data security and requires neither the installation of any software nor any IT integration with a customer’s systems so that that there will never be any data protection issues. AML Analytics is an independent provider of sanction screening system testing technologies with no affinity to any supplier of automated systems.

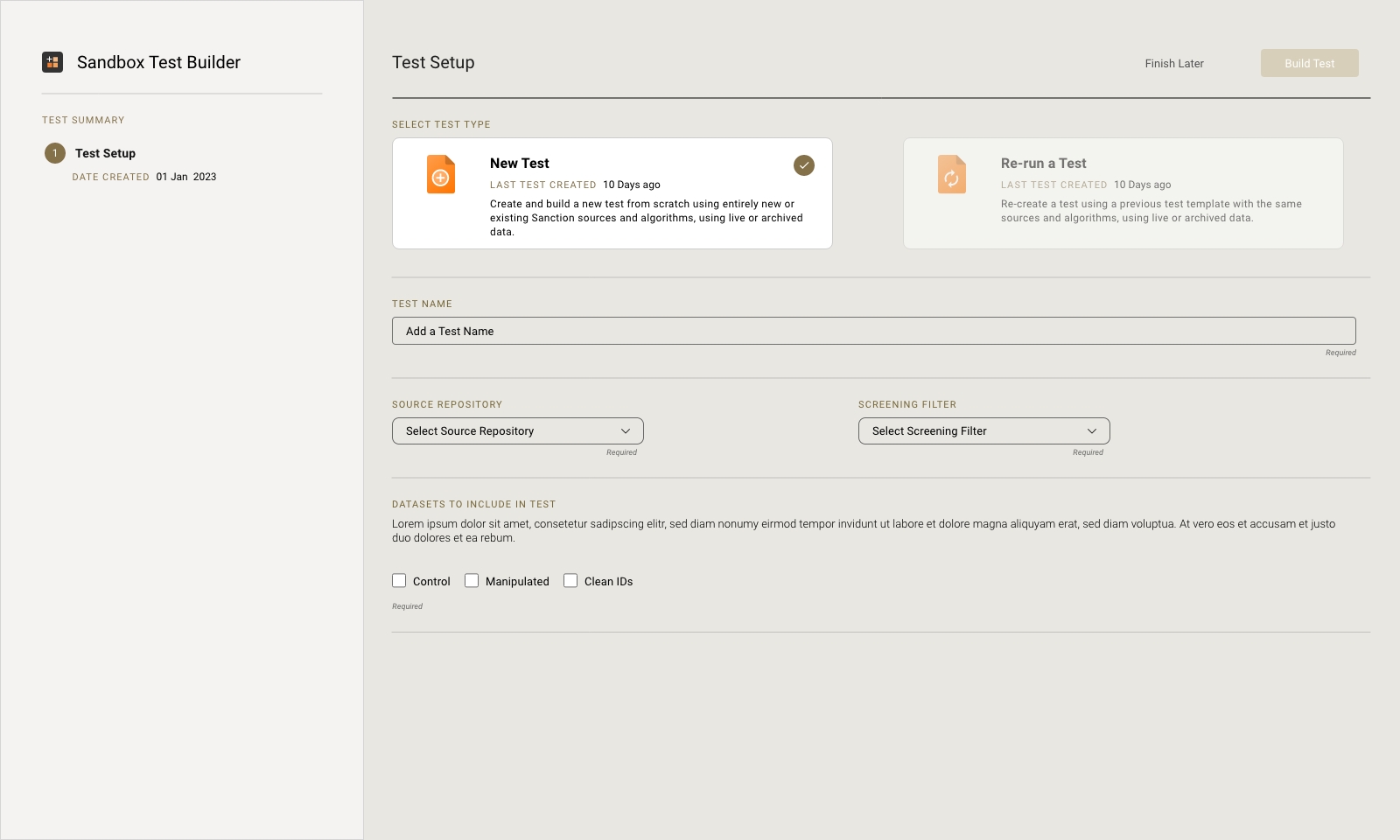

A flexible testing solution

AAT is a versatile solution from AML Analytics, providing a flexible approach to testing a sanction screening system, facilitating the creation of a yearly test for independent system verification and validation on a recurring annual basis as part of a minimum three-year subscription.

Customers need AAT to ensure a system is fit for purpose, facilitating frequent reporting to regulatory authorities that is now required.

In line with regulatory expectation

AAT is tailored to each customer’s specific requirements according to their jurisdiction and risk appetite, and in terms of sanction list selection and test record type.

Testing will ensure that the effectiveness and the efficiency of a screening system is understood using a test containing control records and manipulated records.

Manipulated records will have differing algorithms applied in order to rigorously test the fuzzy logic matching capabilities of your sanction screening system.

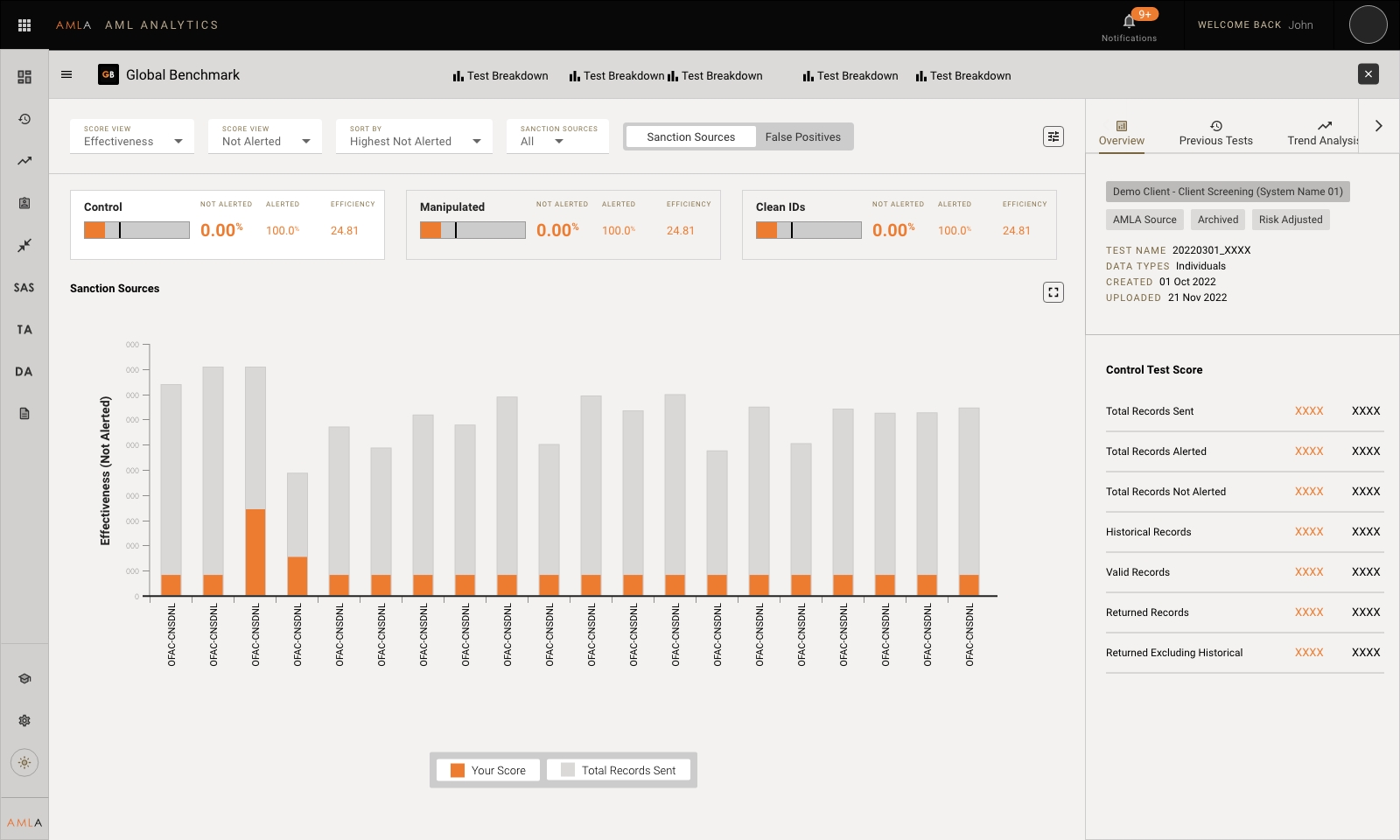

Frequent testing enables performance improvement and enhancement of a sanction screening system through evidence-based tuning and provides independent system validation for frequent reporting to regulators.

Test results are available to view in Analyser Online where you can carry out detailed analysis of results and False Positive rates by viewing sanction records that have hit and missed in granular level detail, as expected by regulators.

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.

Ready to talk?

Don’t hesitate to reach out to us.

info@aml-analytics.com

+44 (0) 1264 889 339