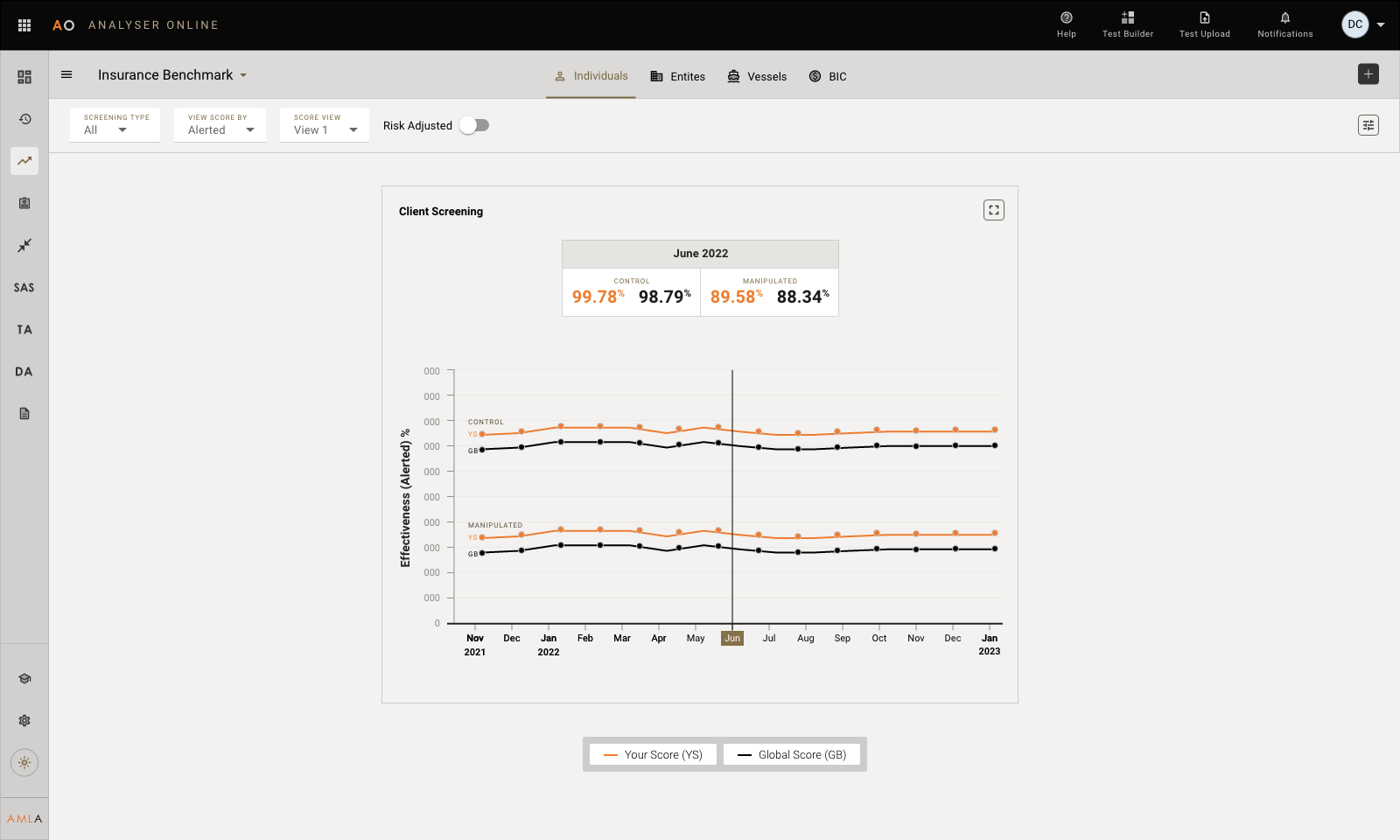

With Insurance Benchmark, insurers can gain competitive advantage by comparing their sanction screening efficiency and effectiveness scores to the scores of their peers around the world.

Insurance Benchmark from AML Analytics is a simple way for an insurance firm to measure the efficiency and effectiveness of its sanction screening system each month and then compare its scores to the aggregated efficiency and effectiveness sanction screening scores of insurers around the world.

The Insurance Benchmark is created specifically from the anonymised monthly sanction screening system test results of insurance firms of all sizes.

It’s the perfect way for insurers to check that their sanction screening performance is in line with the current market standard.

The benefits of Insurance Benchmark

Technology for automated or manual screening systems

Peer-comparative benchmarking to drive ongoing analysis

Improve performance through evidence-based tuning exercises

Peer group comparison provides rigorous comparison metrics

Use compliance as a competitive advantage to outperform peers

Report to regulators with transparency and data-driven answers

One of a kind

AML Analytics is the only company in the world to offer a sanction screening system performance benchmarking solution to the insurance market, and the Insurance Benchmark is our first industry-specific benchmark.

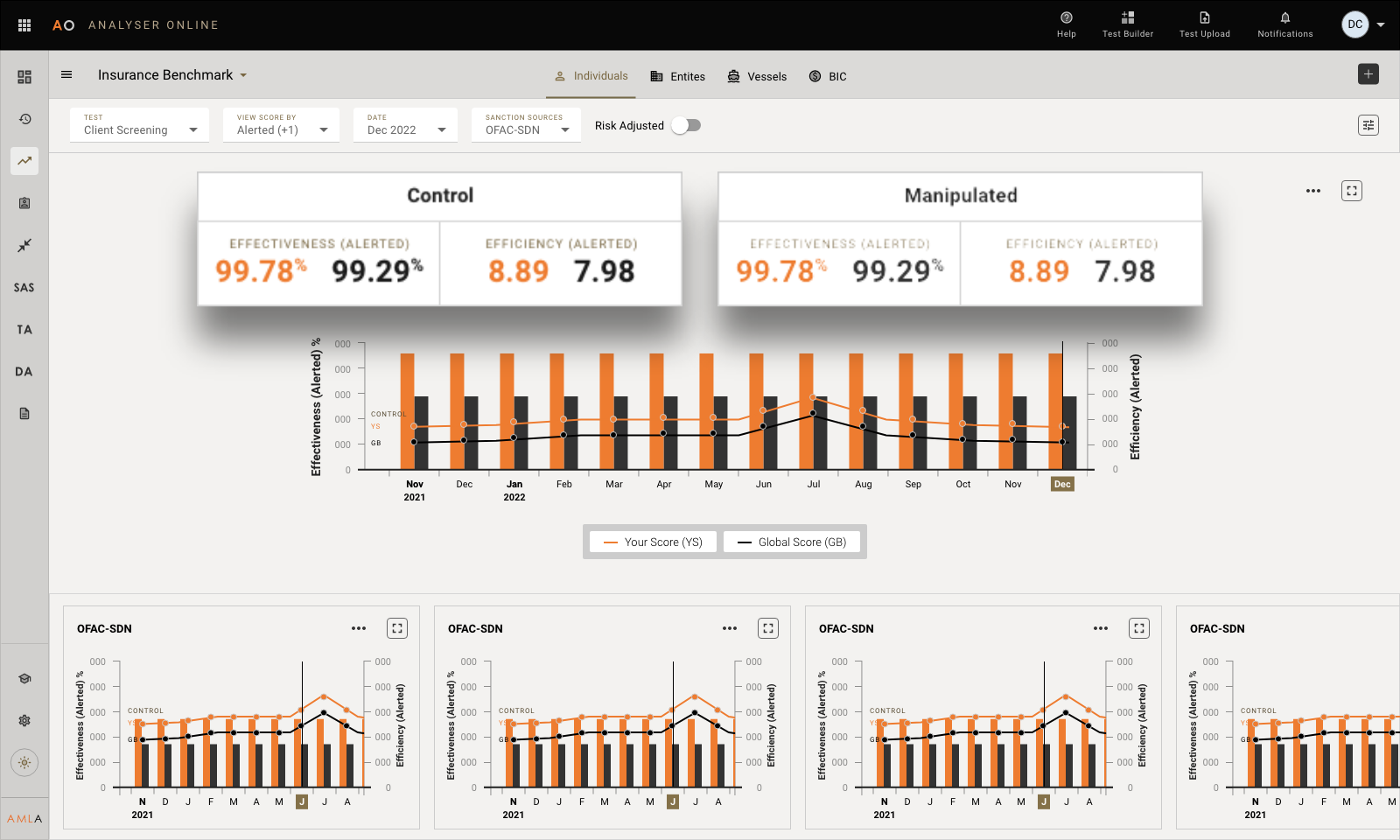

Control and manipulated level

Monthly Insurance Benchmark customer screening system scores are published at both control and manipulated level.

Total data security

No integration with IT systems or access to customer data is ever required so there are no data protection issues, making our Insurance Benchmark testing process simple and straightforward.

Benchmark scores

Global Benchmark

Global Benchmark™ is the solution from AML Analytics that allows financial institutions to measure their sanction screening system performance and then benchmark their scores against industry-standard aggregated scores of their peers around the world.

We publish monthly global, regional and industry-specific benchmark scores for both client and payment screening systems, whilst also providing specific benchmark scores for Chinese character testing!

Asia Benchmark

AML Analytics also offers an additional Benchmark score to customers in Asia called the Asia Benchmark. Asia Benchmark scores are available at both control and manipulated level for customer screening systems and transaction screening systems.

Financial institutions subscribing to our Asia Benchmark service are able to measure their own sanction screening performance and then compare it specifically to their peers in Asia using the Asia Benchmark average scores in Analyser Online™.

Our solutions

Cutting-edge RegTech and SupTech testing, validation and risk assessment solutions for financial institutions and regulatory authorities.

Online Risk Based Systems

ORBS (Online Risk Based Systems) is an ingenious new risk framework solution for intelligent reporting and supervision. It has been created to help governments, regulatory authorities and supervisors understand and assess the levels of AML/CFT risk within their jurisdiction.

Learn More

Analyser Online

Analyser Online is our customer communication hub. It provides access to the most advanced hosted testing facility for sanction screening and transaction monitoring system technologies, offering powerful analytics to help our customers understand test results quickly and easily and take remedial action to mitigate financial crime risk.

Learn More

Global Benchmark

Subscribe to Global Benchmark to measure your sanction screening system performance in terms of efficiency and effectiveness and then regularly benchmark your scores to the industry-standard aggregated scores of your peers around the world.

Learn More

Sandbox

Sandbox is a powerful self-assessment tool designed to test the efficiency and effectiveness of your sanction screening system technologies. Sandbox enables firms to create their own sanction screening system tests to suit corporate requirements and risk appetite.

Learn More

Annual Assurance Testing

AAT is a new, versatile solution that provides a flexible approach to testing a sanction screening system, facilitating the creation of a bespoke test on a recurring annual basis.

Red Flag Tests

Red Flag Tests is designed to carry out an on-the-spot transaction monitoring system health check by exercising red flag rules using Smart Scenarios consisting of millions of rows of synthetic transaction data to mimic the exact transactional patterns of defined money laundering typologies.

Transaction Monitoring Validator

TMV (Transaction Monitoring Validator) is an innovative RegTech solution to enable ongoing, frequent validation and testing of a transaction monitoring system in line with current regulatory requirements.

Learn More

Sanctions Alert Service

The free Sanctions Alert Service (SAS) from AML Analytics provides details of real-time updates to important sanction lists worldwide, allowing financial institutions to monitor sanction list changes as they happen.

Ready to talk?

Don’t hesitate to reach out to us.

info@aml-analytics.com

+44 (0) 1264 889 339